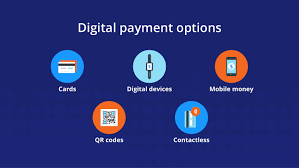

Digital payments have transformed the way people conduct transactions, making payments faster, safer, and more convenient. With advancements in technology, various digital payment methods have emerged, catering to different needs and preferences. Platforms like Coyyn.com official website provide users with seamless payment solutions, enhancing the overall transaction experience. In this article, we will explore the different types of digital payments, their benefits, and how they are shaping the future of financial transactions.

1. Credit and Debit Cards

Credit and debit cards are among the most common forms of digital payments. They offer a cashless way to make purchases, whether online or in physical stores.

- Credit Cards: Allow users to borrow money up to a predetermined credit limit and pay it back later. Popular credit card providers include Visa, MasterCard, and American Express.

- Debit Cards: Deduct money directly from the user’s bank account, ensuring that users only spend what they have.

Both credit and debit cards are widely accepted worldwide and provide security features such as fraud protection, PIN verification, and encryption technology.

Advantages of Credit and Debit Cards

✔️ Quick and convenient transactions

✔️ Global acceptance

✔️ Security features like fraud detection and chargeback protection

2. Mobile Wallets

Mobile wallets, also known as digital wallets, store payment information on smartphones, enabling contactless and cashless transactions. Popular mobile wallets include:

- Apple Pay

- Google Pay

- Samsung Pay

- Paytm and PhonePe (India)

- AliPay and WeChat Pay (China)

These wallets work by linking to a credit card, debit card, or bank account. Users can make payments by scanning QR codes or tapping their phones at NFC-enabled terminals.

Advantages of Mobile Wallets

✔️ Enhanced security with biometric authentication

✔️ Eliminates the need to carry physical cards

✔️ Faster checkout in stores and online

3. Contactless Payments

Contactless payments use Near Field Communication (NFC) technology, allowing users to tap their cards, smartphones, or wearables (like smartwatches) to make payments without physical contact.

This method is gaining popularity as it reduces transaction time and promotes hygiene, especially after the COVID-19 pandemic.

Advantages of Contactless Payments

✔️ Faster transactions compared to cash or chip-and-PIN payments

✔️ Enhanced security due to tokenization and encryption

✔️ Convenient and widely accepted

4. Bank Transfers (NEFT, RTGS, IMPS, and ACH)

Electronic bank transfers are digital payment methods where funds move directly between bank accounts. These transfers can be used for bill payments, salary deposits, and personal transactions.

- NEFT (National Electronic Funds Transfer) – Used for domestic money transfers in India.

- RTGS (Real-Time Gross Settlement) – Suitable for high-value transactions with instant settlement.

- IMPS (Immediate Payment Service) – Available 24/7, allowing instant money transfers.

- ACH (Automated Clearing House) – Used in the U.S. for payroll deposits, bill payments, and tax refunds.

Advantages of Bank Transfers

✔️ Safe and reliable method of transferring funds

✔️ No need for cash handling

✔️ Suitable for both domestic and international transactions

5. Peer-to-Peer (P2P) Payment Apps

P2P payment apps allow users to transfer money directly from one individual to another using a mobile app or website. Some of the most popular P2P apps include:

- PayPal

- Venmo

- Cash App

- Zelle

- Google Pay and Apple Pay (P2P feature)

These apps are widely used for splitting bills, sending money to friends and family, and making quick payments without needing bank account details.

Advantages of P2P Payment Apps

✔️ Instant transfers between users

✔️ No need for cash or bank details

✔️ Secure with encryption and authentication features

6. Cryptocurrencies (Bitcoin, Ethereum, and Stablecoins)

Cryptocurrencies are digital currencies that operate on decentralized networks using blockchain technology. They allow borderless and secure transactions without the need for intermediaries like banks.

- Bitcoin (BTC) – The first and most well-known cryptocurrency.

- Ethereum (ETH) – Supports smart contracts and decentralized applications.

- Stablecoins (USDT, USDC, BUSD) – Digital assets pegged to traditional currencies to reduce volatility.

Though cryptocurrency payments are not yet widely accepted, they are growing in popularity due to their security, decentralization, and potential for investment.

Advantages of Cryptocurrency Payments

✔️ Fast and low-cost international transactions

✔️ No involvement of banks or third parties

✔️ Secure and transparent transactions

7. QR Code Payments

QR code payments involve scanning a quick response (QR) code to complete a transaction. They are widely used in:

- Retail stores

- Restaurants

- Public transport

- Online shopping

Payment apps like AliPay, WeChat Pay, Paytm, and Google Pay allow users to scan merchant-provided QR codes and pay instantly.

Advantages of QR Code Payments

✔️ Easy and convenient, requiring just a smartphone

✔️ No need for physical cash or cards

✔️ Secure with dynamic QR codes preventing fraud

8. Mobile Banking

Mobile banking apps provided by banks allow users to perform financial transactions through their smartphones. Common services include:

- Fund transfers

- Bill payments

- Loan applications

- Account balance checks

Examples include Chase Mobile, Wells Fargo Mobile, HDFC Mobile Banking, and Revolut.

Advantages of Mobile Banking

✔️ Convenient 24/7 access to banking services

✔️ Secure with multi-factor authentication

✔️ Eliminates the need for physical bank visits

9. Internet Banking (Net Banking)

Internet banking allows customers to conduct financial transactions through a bank’s website. It provides features like:

- Online bill payments

- Fund transfers

- Checking account balances

- Loan management

Net banking is widely used for its flexibility, allowing users to handle their finances from anywhere.

Advantages of Internet Banking

✔️ Accessible from any device with an internet connection

✔️ Secure transactions with encryption and OTP authentication

✔️ Saves time by reducing the need for in-person banking

10. USSD-Based Payments

USSD (Unstructured Supplementary Service Data) payments allow users to perform banking transactions without the internet. This method is useful in areas with limited connectivity.

- Dial a specific code (e.g., *99# in India) to access financial services.

- No need for a smartphone or mobile banking app.

- Used for money transfers, checking balances, and making payments.

Advantages of USSD-Based Payments

✔️ Works on basic mobile phones without internet

✔️ Cost-effective and easy to use

✔️ Provides access to banking services in remote areas

Conclusion

The world of digital payments is evolving rapidly, offering a variety of methods to suit different financial needs. Understanding the different types of digital payments helps individuals and businesses choose the best options for their transactions.

From credit cards and mobile wallets to cryptocurrencies and QR codes, the choices are vast and growing. As technology advances, digital payments will continue to become more secure, accessible, and integrated into daily life. Whether you’re paying for groceries, sending money overseas, or investing in crypto, digital payments provide convenience, security, and efficiency for the modern world.